Simplify Your Funds: Just How to File Your Online Income Tax Return in Australia

Declaring your on-line tax obligation return in Australia need not be an overwhelming job if come close to systematically. Comprehending the ins and outs of the tax system and sufficiently preparing your papers are necessary very first steps.

Understanding the Tax System

To navigate the Australian tax obligation system successfully, it is vital to comprehend its fundamental principles and framework. The Australian tax system operates a self-assessment basis, meaning taxpayers are accountable for precisely reporting their earnings and calculating their tax obligation commitments. The main tax obligation authority, the Australian Taxes Workplace (ATO), oversees compliance and enforces tax obligation legislations.

The tax system consists of different components, consisting of earnings tax, solutions and products tax (GST), and resources gains tax (CGT), to name a few. Private income tax obligation is progressive, with prices enhancing as income increases, while corporate tax obligation rates vary for small and huge services. Additionally, tax obligation offsets and deductions are readily available to decrease taxable earnings, enabling even more customized tax responsibilities based on individual circumstances.

Understanding tax obligation residency is also essential, as it figures out an individual's tax commitments. Residents are tired on their globally income, while non-residents are just taxed on Australian-sourced income. Knowledge with these concepts will equip taxpayers to make enlightened decisions, making sure conformity and potentially enhancing their tax obligation end results as they prepare to file their on the internet tax obligation returns.

Readying Your Documents

Gathering the needed records is an essential step in preparing to submit your on-line tax obligation return in Australia. Proper documentation not only enhances the declaring procedure yet also guarantees accuracy, lessening the danger of mistakes that might result in hold-ups or fines.

Begin by collecting your income statements, such as your PAYG repayment summaries from employers, which information your profits and tax kept. online tax return in Australia. Ensure you have your business income records and any kind of pertinent billings if you are freelance. Furthermore, gather bank declarations and documents for any rate of interest made

Next, compile records of insurance deductible expenditures. This might include receipts for occupational expenditures, such as attires, travel, and devices, along with any type of academic expenses connected to your career. If you have residential property, ensure you have documentation for rental revenue and linked costs like repairs or property monitoring charges.

Do not forget to consist of other appropriate documents, such as your wellness insurance coverage information, superannuation contributions, and any kind of investment revenue statements. By diligently organizing these records, you set a strong structure for a smooth and effective on the internet tax obligation return process.

Choosing an Online Platform

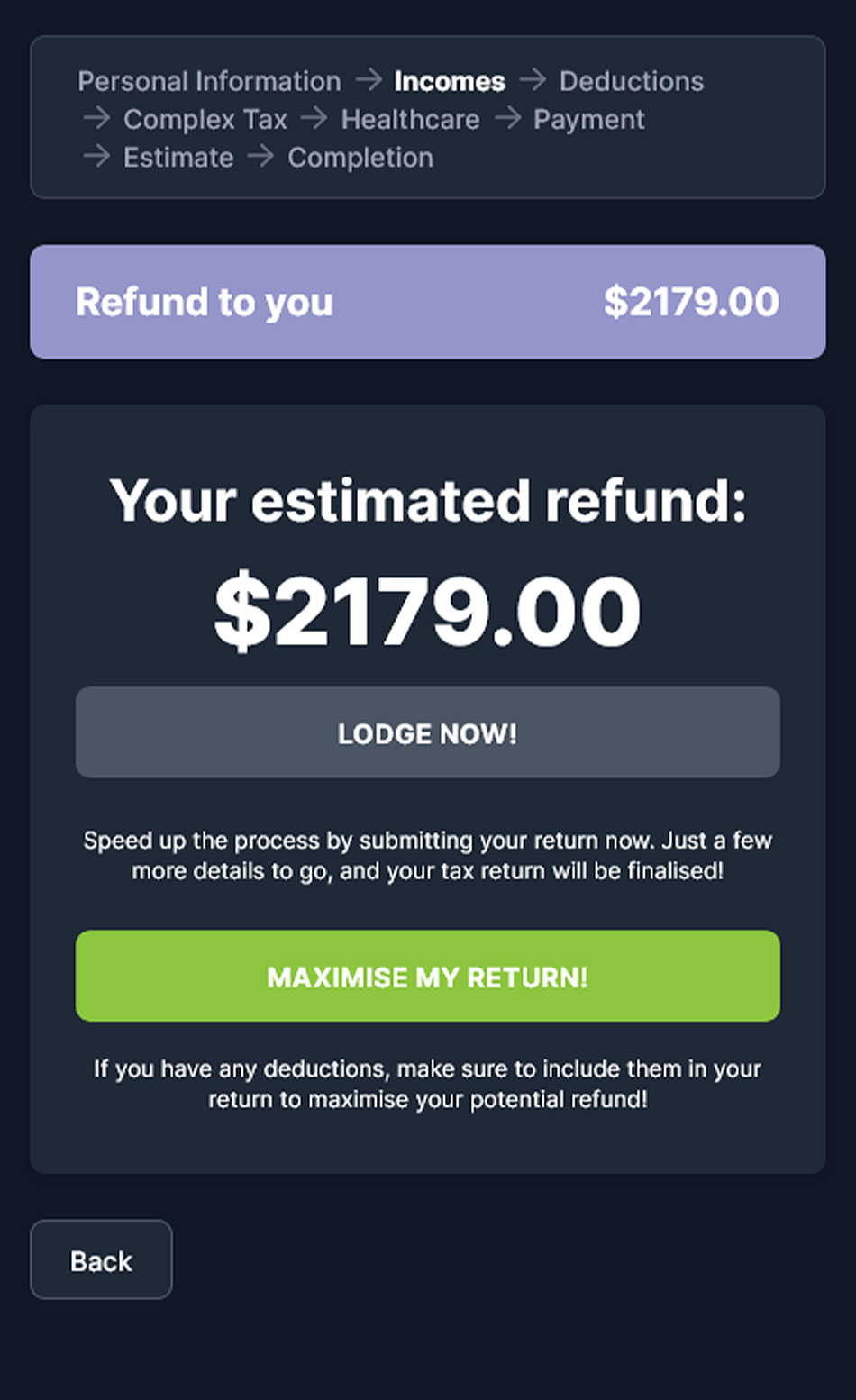

After organizing your documentation, the following step includes picking an ideal online system for submitting your income tax return. online tax return in Australia. In Australia, numerous reputable platforms are offered, each offering special functions customized to various taxpayer needs

When selecting an online platform, consider the customer interface and simplicity of navigation. A straightforward style can significantly improve your experience, making it less complicated to input your details properly. In addition, make certain the system is certified with the Australian Taxation Office (ATO) regulations, my latest blog post as this will assure that your submission fulfills all legal requirements.

Platforms offering online talk, phone assistance, or comprehensive Frequently asked questions can supply important support if you encounter challenges throughout the declaring process. Look for platforms that make use of security and have a strong privacy policy.

Lastly, consider the costs connected with various platforms. While some may provide totally free solutions for standard tax returns, others might bill fees for advanced functions or additional assistance. Weigh these elements to pick the platform that straightens ideal with your economic situation and declaring needs.

Step-by-Step Declaring Procedure

The step-by-step declaring procedure for your on the internet tax obligation return in Australia is made to improve the submission of your monetary info while making sure conformity with ATO regulations. Begin by gathering all essential records, including your income declarations, bank declarations, and any type of invoices for reductions.

As soon as you have your documents ready, visit to your Go Here selected online system and produce or access your account. Input your personal information, including your Tax obligation Documents Number (TFN) and get in touch with details. Next, enter your earnings information precisely, making certain to consist of all resources of revenue such as incomes, rental earnings, or financial investment earnings.

After describing your earnings, go on to assert eligible reductions. This might consist of occupational costs, philanthropic donations, and medical costs. Be certain to evaluate the ATO standards to optimize your cases.

Once all details is gotten in, thoroughly review your return for accuracy, remedying any type of inconsistencies. After guaranteeing every little thing is appropriate, submit your income tax return online. You will obtain a confirmation of entry; keep this for your documents. Last but not least, check your account for any updates from the ATO concerning your tax return condition.

Tips for a Smooth Experience

Completing your online income tax return can be an uncomplicated process with the right prep work and mindset. To guarantee a smooth experience, start by collecting all needed records, such as your revenue declarations, invoices for deductions, and any type of various other appropriate economic records. This company conserves and decreases mistakes time during the declaring procedure.

Following, familiarize on your own with the Australian Tax Office (ATO) internet site and its on-line services. Utilize the ATO's sources, including guides and Frequently asked questions, to clarify any kind of unpredictabilities before you start. online tax return in Australia. Take into consideration setting up a MyGov account linked to the ATO for a structured declaring experience

In addition, take advantage of the pre-fill functionality supplied by the ATO, which immediately occupies several of your info, decreasing view it now the opportunity of errors. Guarantee you double-check all access for precision before entry.

Lastly, allow yourself adequate time to finish the return without feeling rushed. This will assist you maintain emphasis and lower anxiousness. Don't be reluctant to consult a tax professional or use the ATO's assistance services if complications emerge. Following these suggestions can lead to a effective and convenient online income tax return experience.

Verdict

Finally, submitting an on-line income tax return in Australia can be structured via mindful prep work and choice of appropriate resources. By understanding the tax system, organizing necessary files, and picking a certified online system, people can browse the declaring process efficiently. Adhering to an organized strategy and using offered assistance guarantees accuracy and maximizes eligible deductions. Ultimately, these practices add to an extra effective tax obligation declaring experience, streamlining monetary management and enhancing conformity with tax obligation obligations.